10 Factors That Influence Bitcoin’s Rise and Fall Globally

Bitcoin (BTC), the first and most prominent cryptocurrency, has become a central figure in global finance and digital investment. Since its creation in 2009, Bitcoin’s value has experienced dramatic ups and downs, captivating investors, economists, and policymakers alike. Understanding what drives these price fluctuations is essential for anyone involved in the crypto space.

From economic policies to technological developments, multiple factors play a role in Bitcoin’s volatility. Below are ten key factors that influence the global rise and fall of Bitcoin.

1. Market Demand and Supply

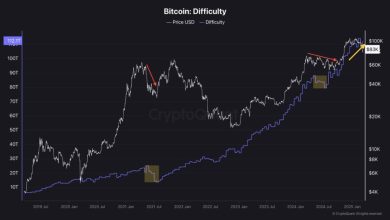

The most fundamental factor affecting Bitcoin’s price is supply and demand. Bitcoin has a fixed supply cap of 21 million coins — no more can ever be created. As demand increases and the number of available coins decreases, prices tend to rise. Conversely, when fewer investors are buying or selling pressure grows, prices decline.

Bitcoin’s “halving” events, which occur approximately every four years, cut the block rewards miners receive in half. These events effectively slow the rate of new Bitcoin entering circulation, often leading to price surges due to scarcity.

2. Global Economic Conditions

Economic uncertainty often influences Bitcoin’s price movements. During periods of inflation, currency devaluation, or financial crises, many investors view Bitcoin as a “digital gold” — a hedge against traditional financial instability. For example, when the U.S. dollar weakens or inflation rises, Bitcoin demand may increase as people seek alternatives to fiat currencies.

However, during global recessions or liquidity shortages, investors might sell Bitcoin to cover other losses, leading to price drops. Thus, Bitcoin can act as both a safe haven and a high-risk asset, depending on market sentiment.

3. Regulation and Government Policies

Regulation is one of the most powerful external influences on Bitcoin’s price. Positive regulatory developments — such as legal recognition, institutional adoption, or the approval of Bitcoin ETFs — typically drive prices higher by boosting investor confidence.

On the other hand, government crackdowns, restrictions on exchanges, or outright bans in major markets can trigger sell-offs. For instance, China’s ban on crypto mining and trading in 2021 caused a temporary market collapse. Similarly, U.S. Securities and Exchange Commission (SEC) actions against major crypto platforms can create uncertainty, leading to volatility.

4. Institutional Adoption

Institutional participation has become a major force behind Bitcoin’s growth. When companies like Tesla, MicroStrategy, or investment funds like BlackRock announce Bitcoin purchases, it signals legitimacy to traditional investors, often sparking upward momentum.

Conversely, when institutions reduce holdings or delay crypto-related projects, it can lead to bearish trends. Institutional adoption not only affects prices but also influences public perception and long-term market stability.

5. Technological Developments and Network Upgrades

Bitcoin’s technological evolution also affects its valuation. Improvements in scalability, transaction speed, and security can enhance user confidence and drive adoption. Upgrades such as the Taproot update (which improved efficiency and privacy) often generate positive sentiment.

Meanwhile, potential security threats, forks, or network congestion can damage trust and negatively impact prices. Continuous innovation is vital for maintaining Bitcoin’s competitiveness against emerging cryptocurrencies with advanced capabilities.

6. Media Influence and Public Sentiment

Media coverage plays a critical role in shaping Bitcoin’s price direction. Positive news — such as endorsements from influential figures or announcements of mainstream adoption — tends to create excitement and drive prices upward. Elon Musk’s tweets about Bitcoin in 2021, for instance, caused massive short-term price movements.

Negative media stories, including exchange hacks, fraud cases, or environmental concerns about Bitcoin mining, can quickly erode investor confidence and trigger panic selling. The market’s emotional nature means perception can often move prices more than fundamentals.

7. Mining Costs and Energy Prices

Bitcoin mining requires significant computing power and energy. When electricity prices rise, mining becomes more expensive, reducing profit margins for miners. If the cost of production exceeds Bitcoin’s market price, miners may sell their holdings or shut down operations, increasing supply and putting downward pressure on prices.

Conversely, lower energy costs or technological advances in mining equipment can encourage more mining activity, potentially stabilizing the network and influencing upward trends over time.

8. Market Speculation and Whale Activity

Speculation drives much of Bitcoin’s volatility. Large holders — known as “whales” — can significantly impact prices when they buy or sell substantial amounts of Bitcoin. Even rumors of whale movements can create market waves, as smaller investors follow their perceived strategies.

Short-term traders using leverage also amplify price swings. When prices rise sharply, FOMO (fear of missing out) drives more buying, pushing prices even higher. But when corrections occur, panic selling can lead to steep declines, creating the infamous “boom-and-bust” cycles in Bitcoin’s history.

9. Competition from Other Cryptocurrencies

Bitcoin may be the pioneer of digital assets, but it faces growing competition from thousands of altcoins. Ethereum, Solana, and newer blockchain projects offer faster transactions, smart contracts, and lower fees, drawing investor attention away from Bitcoin.

When altcoin markets perform well, capital often flows out of Bitcoin into alternative projects, lowering its dominance and price. However, Bitcoin usually regains strength during bear markets, as investors seek stability in the most established crypto asset.

10. Geopolitical Events and Global Uncertainty

Geopolitical tensions, wars, and international sanctions can have a mixed effect on Bitcoin. On one hand, people in unstable economies or sanctioned regions may turn to Bitcoin as a censorship-resistant means of transferring value. For example, during crises in countries like Venezuela or Ukraine, crypto adoption spiked as citizens sought to preserve wealth.

On the other hand, global instability can also reduce investor appetite for risky assets. When fear spreads through traditional markets, some investors exit crypto positions to move back into cash or gold, leading to temporary declines in Bitcoin’s value.

Conclusion

Bitcoin’s price movements result from a complex interplay of economic, social, technological, and psychological factors. From global regulations to mining costs and investor sentiment, each element contributes to its unpredictable nature. While volatility remains one of Bitcoin’s defining traits, it also presents opportunities for informed investors who understand the forces at play.

To navigate Bitcoin’s ever-changing landscape, one must stay informed, think long-term, and separate hype from fundamentals. via tracking these ten key factors — market demand, economic trends, regulation, institutional adoption, technology, media influence, mining costs, speculation, competition, and geopolitics — investors can better anticipate market shifts and make more strategic decisions in the dynamic world of cryptocurrency.